30+ writing off mortgage interest

Web Mortgage interest. Save your registration statements.

What Is The Monthly Repayment On A 800000 00 Mortgage With 250000 00 Deposit Quora

Web Can You Write Off Mortgage Interest.

. Web Basic income information including amounts of your income. Create Your Satisfaction of Mortgage. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Web 2 days agoAPR is the all-in cost of your loan. There could be a tax deduction hiding. Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and.

Ad Developed by Lawyers. Web You can write off some mortgage closing costs at tax time. You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

In addition to itemizing these conditions must be met for mortgage interest to be deductible. Look in your mailbox for Form 1098. Ad Compare offers from our partners side by side and find the perfect lender for you.

You see in the US mortgage interest is considered tax-deductible. When its time to renew your registration on a vehicle check if any part of the fee is actually property tax. Web Home mortgage interest.

Get Your VA Loan. Closing costs typically range between 2 and 6 of your loan amount. Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is.

Web As of the beginning of 2018 couples who file their taxes jointly are only able to deduct interest on up to 750000 of eligible mortgages which is down from 1 million. Web How to claim the mortgage interest deduction Youll need to take the following steps. Web For example if you borrowed 250000 on a 30-year fixed-rate loan at 4 percent interest then paid 12000 in mortgage payments over the course of the year.

31 which details the mortgage interest you paid during. Fast VA Loan Preapproval. In this case as a couple.

LawDepot Has You Covered with a Wide Variety of Legal Documents. Web You cant deduct the principal the borrowed money youre paying back. With todays interest rate of 692 a 30-year fixed mortgage of 100000 costs approximately 660 per month in principal and.

Contact a Loan Specialist. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage.

Form 1098 a mortgage tax. The benefits of claiming your mortgage interest. Trusted VA Loan Lender of 300000 Veterans Nationwide.

However higher limitations 1. At least in most circumstances you can. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment.

Web Your mortgage lender should send you a Form 1098 a mortgage interest statement by Jan. This means when you. Web Form 1098 is the statement your lender sends you to let you know how much mortgage interest you paid during the year and if you purchased your home in the.

Ad VA Loan Expertise Personal Service. Your mortgage lender sends you. 2000 Your total itemized deductions come out to 14500.

Web Claiming your mortgage interest can be an effective way to reduce your income and increase your deductions.

What Is A Tax Write Off And How Does It Work

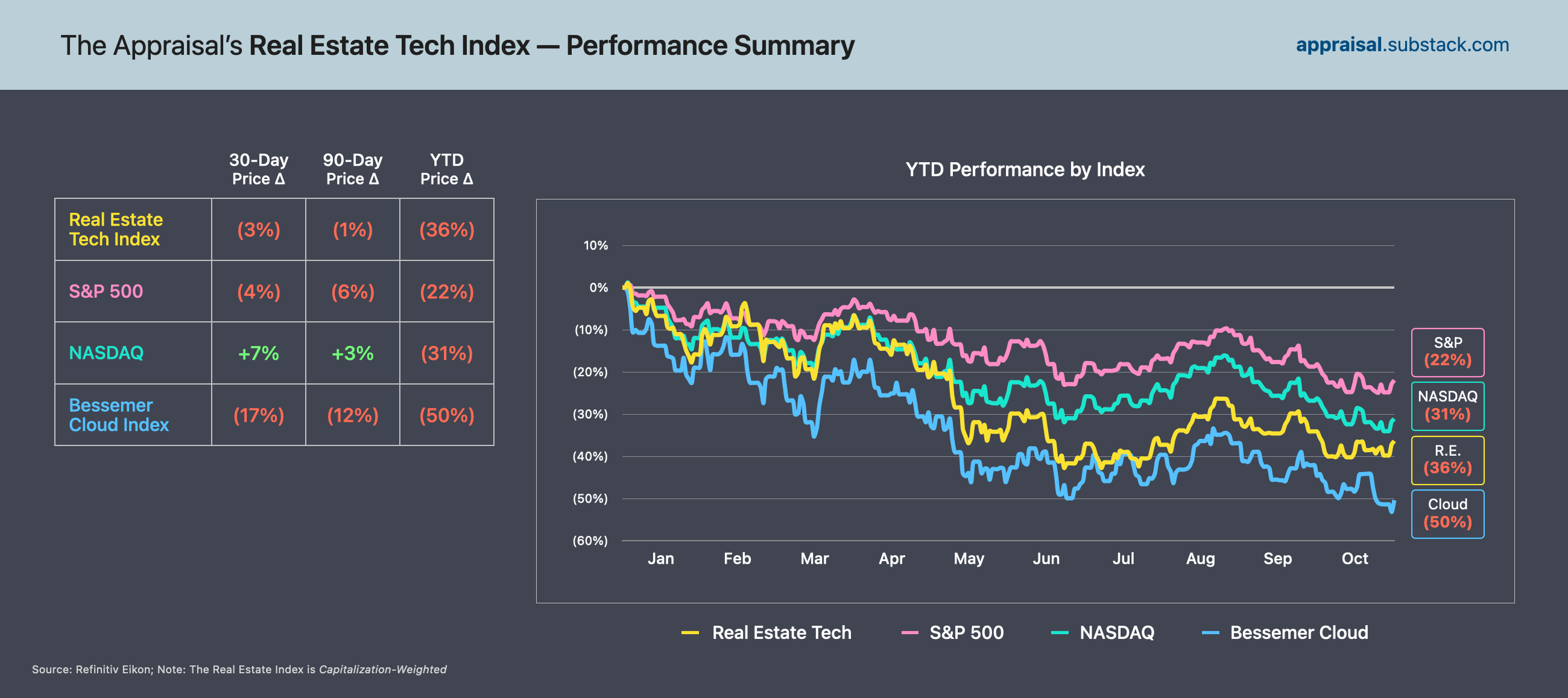

The Appraisal October 2022 Real Estate Tech Market Map Multiples Update

![]()

30 Time Management Guide For Personal Finance

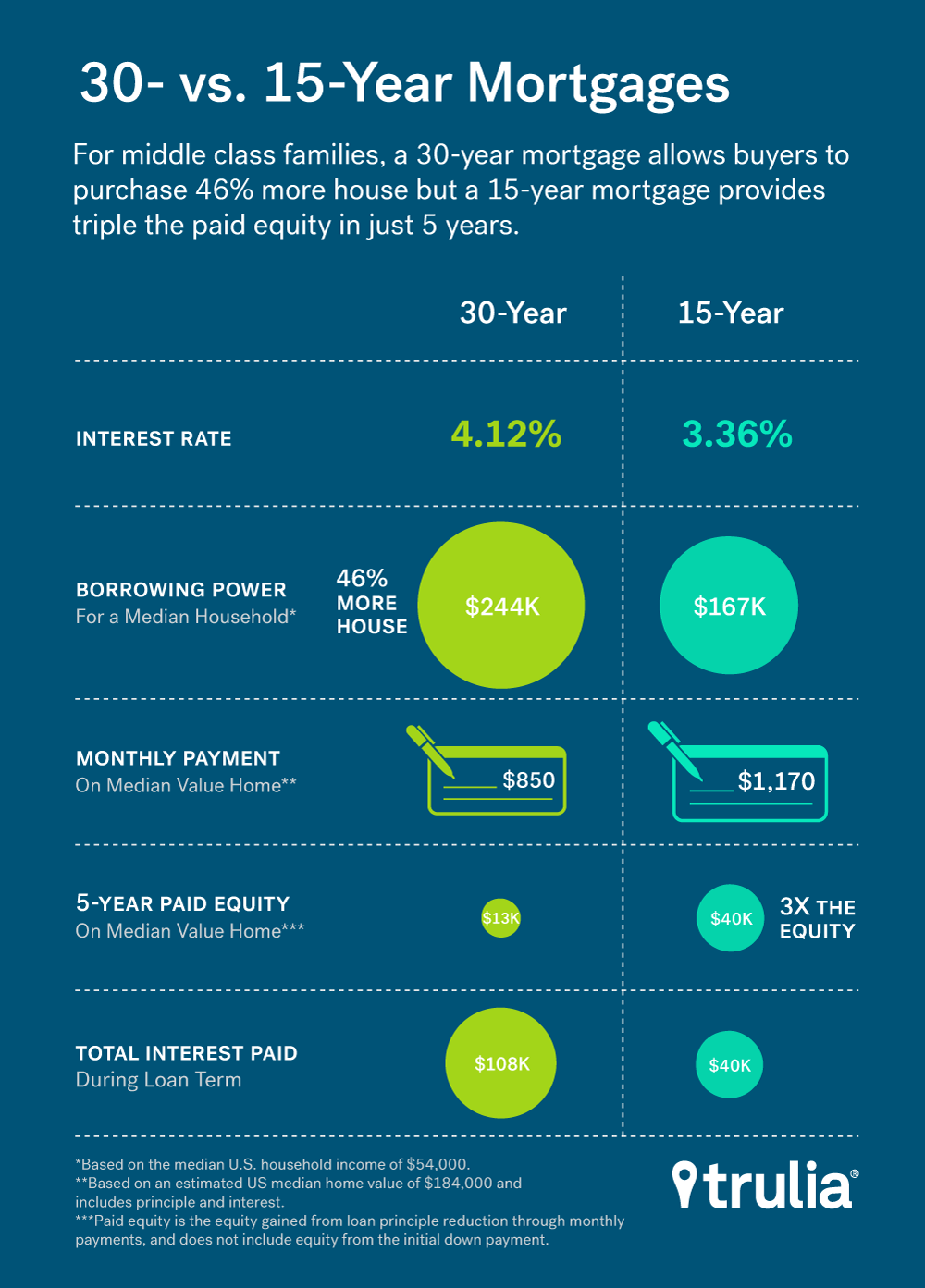

Where 15 Can Beat 30 Trulia Research

1lmkmueivjlmwm

Maximum Mortgage Tax Deduction Benefit Depends On Income

Paying Down A 30 Year Mortgage Faster Vs 15 Year Mortgage My Money Blog

What To Do If Your Fixed Rate Or Interest Only Term Expire In 2023

Can A Butcher Claim Meat Shrinkage And Spoilage As A Tax Deduction Quora

Blank Printable Lease Agreement How To Create A Blank Printable Lease Agreement Download This Bl Lease Agreement Rental Agreement Templates Being A Landlord

Dave Ramsey Do The Math And Make A Smart Decision If You Re Ready To Buy Or Need To Refinance Get In Touch With The Only Company I Trust To Walk Alongside

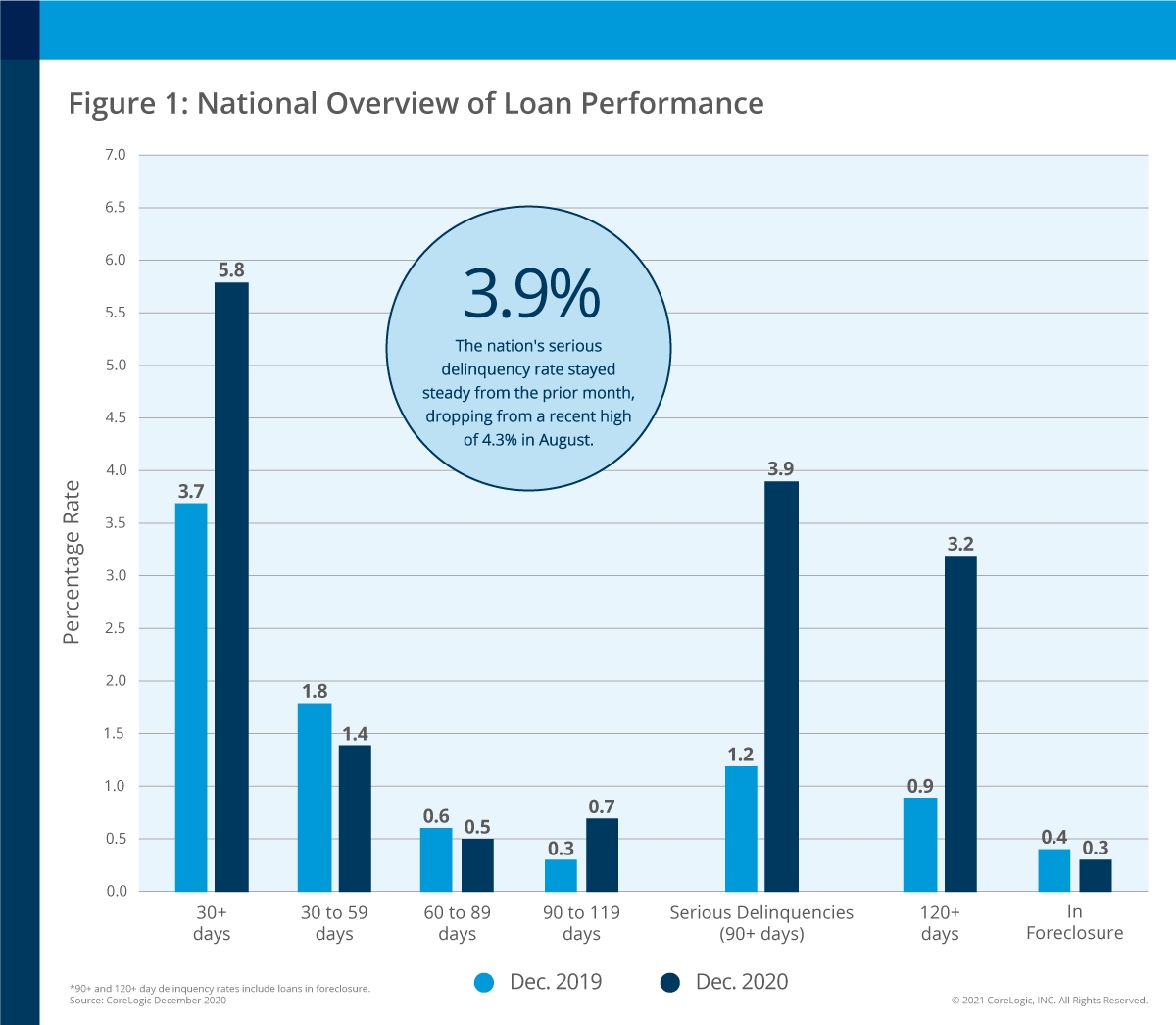

A Look Back Us Mortgage Delinquency Rates Experience Record Highs And Lows In 2020 Corelogic Reports Business Wire

Real Estate Decoded

Monument Mortgagecare Gesture Of Goodwill Moneysavingexpert Forum

5 Reasons Why A 20 Year Mortgage Is A Great Option Credit Sesame

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Can I Deduct My Mortgage Interest